Concerns of security overreach raised by Biden's blocking of steel deal

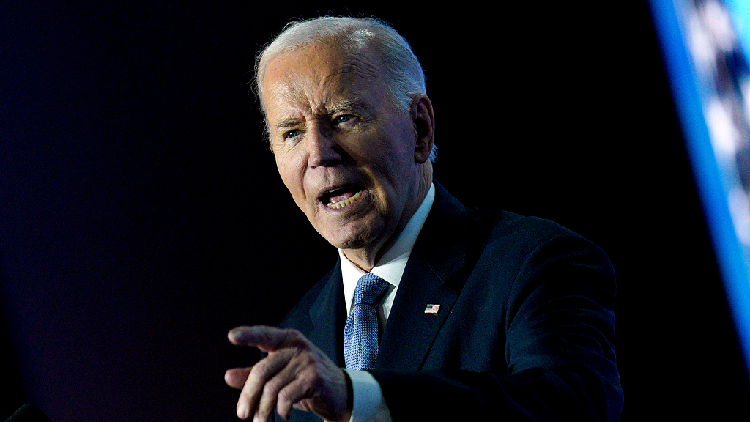

On January 13, 2025, the Biden Administration postponed the enforcement of its order to block Japanese company Nippon Steel's proposed $14.9 billion acquisition of US Steel until June 18, 2025. This contentious decision, made by Biden about a week prior, was based on national security concerns. Notably, the Committee on Foreign Investments in the United States had conducted a comprehensive review of the proposed deal over the past year but did not come to a consensus regarding security issues.

On January 13, 2025, the Biden Administration announced a delay in enforcing its order to block Japanese Nippon Steel's proposed $14.9 billion acquisition of US Steel, pushing the decision deadline to June 18, 2025. This controversial move, made less than a week prior, was justified by Biden on national security grounds. Notably, the Committee on Foreign Investments in the United States (CFIUS) had conducted a comprehensive review of the proposed acquisition over the past year but was unable to reach a consensus regarding security concerns. As a result, the president held the decisive vote regarding the deal's approval. Predictably, both Nippon Steel and US Steel quickly objected to Biden's decision, filing a lawsuit in federal court three days after the announcement. They contended that the CFIUS review had been biased due to the president's longstanding opposition to the merger.

Why are both steel companies advocating for the acquisition?

US Steel, based in Pittsburgh, has historically been a leader in the American steel industry. However, as US manufacturing has declined over recent decades, the company has seen its market share and competitiveness eroded by foreign rivals. A decrease in revenue has constrained US Steel’s ability to update its equipment and talent, creating a negative cycle that has ultimately led the company to a crisis mode of survival.

Conversely, Nippon Steel, which ranks as the world’s fourth-largest steel producer, has expressed its readiness to invest in US Steel’s aging blast furnace facilities located in Pennsylvania and Indiana. By doing so, the new joint entity aims to enhance its competitiveness in both domestic and international markets. Nippon Steel has also pledged to uphold all existing union contracts associated with US Steel while preserving its name, brand, and headquarters. Following the announcement of the deadline extension, US Steel's stock rose nearly 7 percent.

Concerns over the national security rationale

Biden has defended his blockage of the acquisition by referencing the Defense Production Act of 1950, asserting that “a strong domestically owned and operated steel industry represents an essential national security priority and is critical for resilient supply chains. That is because steel powers our country: our infrastructure, our auto industry, and our defense industrial base.” However, Sarah Bauerle Danzman, an associate professor at Indiana University, Bloomington, and a nonresident senior fellow at the GeoEconomics Center, points out the irony of Biden’s national security justification, suggesting that it contradicts his own executive order issued in September 2022. That order delineated the factors CFIUS should consider during security reviews and defined critical supply chains in accordance with EO 14017, which notably did not include steel. This casts Biden's rationale in a light that suggests a substantial expansion of national security considerations, potentially undermining the credibility of White House executive orders.

Implications for national interests

From a national interest perspective, Biden’s decision poses risks to the U.S. steel industry, local communities, and the nation’s global economic stature. US Steel faces a lost opportunity to modernize its facilities and management, which would further hinder its ability to compete with foreign firms. Republican Representative Dan Meuser has criticized the president’s ruling as shortsighted, stating it "sacrifices Pennsylvania's economic future for political friends, leaving thousands of families and communities uncertain about their future."

Moreover, blocking the acquisition could adversely affect the business climate in the U.S. The political nature of such decisions may lead to apprehension among foreign investors regarding possible obstacles to their business transactions. Biden’s rationale demonstrates that he could expand the definition of national security to align with political interests, potentially deterring foreign enterprises from investing in the U.S. This, in turn, could jeopardize the administration's goal of reshoring manufacturing industries.

A bleak outlook ahead

The extension of the deadline appears to be a strategic move by Biden to place the final decision in the hands of the incoming Trump administration. Notably, Trump has also expressed strong opposition to the acquisition, asserting that he is "totally against the once great and powerful US Steel being bought by a foreign company, in this case Nippon Steel of Japan." In the coming months, CFIUS will fulfill its duties to explore potential workarounds or modifications to facilitate the acquisition; however, the ultimate decision will lie with Trump. Given his inclination to prioritize American interests in the next four years, the chances of the acquisition proceeding look increasingly dim.

Navid Kalantari for TROIB News

Find more stories on Business, Economy and Finance in TROIB business