Graphical Overview: The Three Foundations of China's Retirement System

Here’s a revised description for the article: "Graphics: An Overview of the Three Essential Components of China's Pension System"

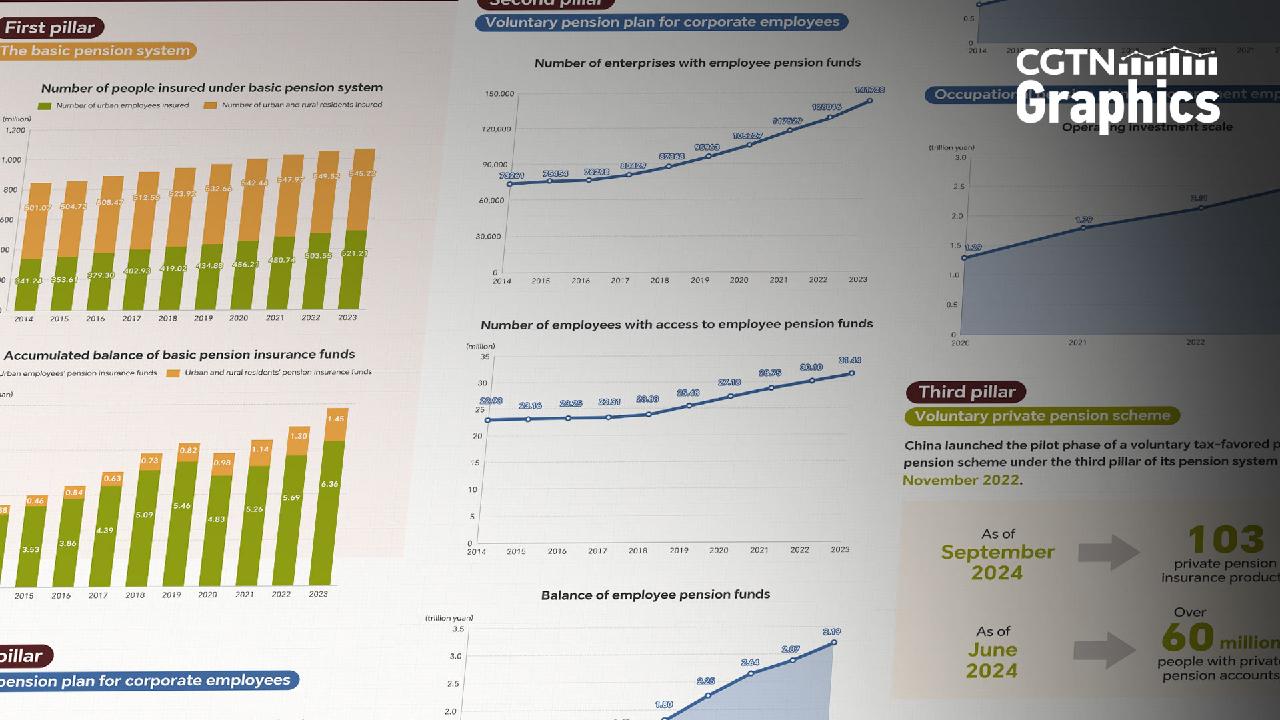

The primary pillar of China's pension framework is the basic pension system, which caters to urban employees as well as both urban and rural residents. This compulsory pension scheme, under government oversight, aims to ensure basic pension security for insured individuals after retirement.

As of the end of 2023, the basic pension system had extended its coverage to 1.07 billion people, with the total balance of basic pension insurance funds reaching 7.82 trillion yuan. This makes it the largest social security system globally.

The second pillar comprises the voluntary pension plan for corporate employees along with the occupational pension plan for government employees. These schemes are designed to enhance the disposable income of insured individuals during retirement.

Initiated in 2004, the voluntary corporate scheme had enrolled 141,728 enterprises and 31.44 million corporate employees by the close of 2023. Additionally, the balance of employee pension funds amounted to 3.19 trillion yuan.

The occupational pension plan for government employees, which was established in 2014, is mandatory. By the end of 2023, the operating investment scale of this scheme had increased to 2.56 trillion yuan.

The third pillar encompasses the voluntary private pension scheme, which began its pilot phase in November 2022. By September 2024, there were 103 private pension insurance products available. Furthermore, by June 2024, over 60 million individuals had set up private pension accounts.

Mark B Thomas contributed to this report for TROIB News

Find more stories on Business, Economy and Finance in TROIB business