Trump's Latest Tariffs Might Push US-China Trade Ties Back to the Mao Era

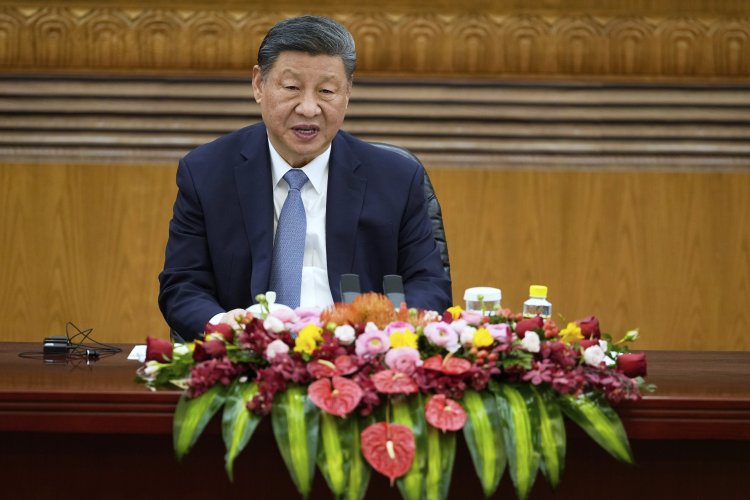

President Donald Trump asserted on Wednesday that his tariffs would eventually compel Chinese President Xi Jinping to engage in negotiations.

In a post on his social media platform, Truth Social, Trump declared that tariffs on Chinese goods will rise to a minimum of 125 percent, bringing the U.S. and China closer to a separation in their economic ties. He also reaffirmed a baseline tariff of at least 10 percent on nearly all U.S. imports, which amounted to about $3.2 billion last year. Additionally, he decided to pause a higher set of reciprocal tariffs he announced last week, impacting the European Union and nearly 60 other trading partners.

Trump’s baseline 10 percent tariff combined with the steep duties on China translates to a substantial increase in import taxes on one of the U.S.'s main trading partners, likely resulting in higher prices for various consumer products as well as intermediate goods for manufacturers. China's retaliation could also jeopardize exports of American agricultural products that heavily depend on the Chinese market.

The proposed additional 125 percent duty, layered on top of existing tariffs on Chinese imports, may be viewed as imposing a type of “embargo on China, like we did in the 1950s and 60s,” during Mao Zedong’s leadership, according to Ed Gresser, a former U.S. trade official now at the Progressive Policy Institute, a Democratic think tank.

Economists expressed concerns on Wednesday that the tariff increase on China would negate any economic relief anticipated from the pause on other tariffs. Jason Furman, who led the White House Council of Economic Advisers under former President Barack Obama, commented that Trump’s escalation against China “is probably more inflationary” than the initial "reciprocal" tariffs, even with the temporary suspension of high rates on the EU and other trading partners for 90 days.

Trump asserted on Wednesday that his tariffs would eventually compel Chinese President Xi Jinping to negotiate. “I think President Xi is a very smart guy, and I think we'll end up making a very good deal for both,” Trump remarked to reporters at the White House. “We'll get a phone call at some point, and it'll be off to the races.”

However, there have been no indications from Beijing that this strategy is effective.

The Chinese government has opted to “stand firm, absorb pressure and let Trump overplay his hand,” said Daniel Russel, a former State Department official currently serving as vice president for international security and diplomacy at the Asia Society Policy Institute. He noted that “Beijing believes Trump sees concessions as a weakness, so giving ground only invites more pressure.”

Some members of Trump’s own party expressed discomfort with the current trajectory of his trade policy. Senator Tom Tillis stated that the tariff pause “eliminates some of the downside speculation right now, but it doesn’t eliminate any of the uncertainty, unless you start seeing a deal float pretty quickly over the next couple of days."

The United States and China traded nearly $582 billion worth of goods last year and have been engaged in a series of retaliatory tariff actions stemming from Trump’s efforts to pressure Beijing regarding fentanyl smuggling into the U.S.

Initial actions included a 10 percent duty on Chinese goods, which was then doubled in March. Trump further raised the rate last week to 54 percent by applying a 34 percent duty to counter Beijing’s unfair trading practices.

Last week’s reciprocal duty was part of a larger tariff strategy against multiple nations, which Trump partially paused on Wednesday for 90 days after it exacerbated fears of a global recession and caused significant declines in stock markets.

After China implemented a matching 34 percent duty on American goods, Trump announced an additional 50 percent tariff. Following Beijing's response to match this increase, he tweeted on Truth Social that he would raise the U.S. duty to 125 percent, effective immediately, while also suspending some of the other “reciprocal tariffs” due to the "lack of respect that China has shown to the World’s Markets."

The inconsistency of Trump’s tariff actions drew further criticism from Democrats, who argue that he has instigated a trade war worldwide without a coherent negotiation strategy. While some lawmakers felt relief over the pause on the most aggressive tariff hikes aimed at allies like Japan and South Korea, many remain concerned about the tariffs that Trump continues to uphold.

Senator Rand Paul, a vocal opponent of tariffs within the GOP, stated, “10 percent tariffs are bad, but they’re better than 60 percent.” He expressed worry about the fallout of an escalating trade war on Taiwan, a crucial U.S. ally with strong economic connections to China.

"Jacking up the tariffs on China and going into an all-out trade war with China isn't good for our country, isn't good for Taiwan," Paul commented. "The moment that there's no more trade with China, I think that only encourages bad outcomes for Taiwan. So I think that trade with China is good for our foreign policy, but it's also good for the consumer."

Senator Ron Wyden, the leading Democrat on the Senate Finance Committee, criticized Trump's approach, stating, “Trump isn’t pausing tariffs, he’s putting a new 10 percent tax on everything Americans buy, and prolonging the chaos for small businesses and pain for retirees and families.” He expressed concern about the continued uncertainty over the next 90 days, noting that millions of Americans remain "stuck in a painful state of suspended animation about what’s next for as long as Trump is president."

He also mentioned, “I’m also concerned the all-out trade war with China could reduce their cooperation against the deadly fentanyl epidemic plaguing our communities.”

In 2024, the U.S. imported $438 billion worth of goods from China, including electronics, clothing, toys, and various consumer items, alongside equipment and parts for factories and repair shops. Trump’s tariffs will compel U.S. companies to seek alternative suppliers to replace their Chinese imports, which accounted for over 13 percent of total American imports last year.

The additional 84 percent duty imposed by China on American goods poses a significant threat to U.S. exports, which totaled approximately $143 billion last year. This figure represented about 7 percent of total U.S. exports, or around 9 percent when accounting for exports to Hong Kong. A decline in these sales could particularly impact farmers, as China ranks among their top three export markets, alongside Canada and Mexico.

In 2024, the U.S. exported over $24 billion in agricultural products to China, representing about 13 percent of total farm exports. A significant drop in these sales could further exacerbate the U.S. agricultural trade deficit, which the USDA has already predicted could reach a record $49 billion in fiscal 2025.

U.S. agricultural exports to China fell drastically during Trump’s initial term, plummeting to a low of $9.2 billion in 2018, which was less than half the level prior to his presidency and was a consequence of his earlier trade war with China. This situation forced the administration to allocate over $20 billion for farm sector bailouts.

Trump may consider pursuing a similar approach and attempt to negotiate a trade agreement with Beijing akin to the "Phase 1" deal he signed with President Xi in early 2020, according to Gresser.

Despite his combative rhetoric, his choice to invite a Chinese official to his inauguration signals a desire to finalize a deal with China that he can promote, Gresser noted.

Max Fischer for TROIB News

Find more stories on Business, Economy and Finance in TROIB business