Nvidia experiences unprecedented single-day decline in stock market value

Nvidia's stock saw a sharp decline of 17% on Monday, resulting in a loss of around $589 billion in its market capitalization.

Nvidia's stock plunged 17% on Monday, resulting in a loss of approximately $589 billion in market capitalization and marking the largest single-day decline in US corporate history. This steep drop was fueled by increasing competition from the Chinese artificial intelligence company DeepSeek.

This decline was part of a wider downturn in the tech sector, with the Nasdaq Composite falling 3.1%, its worst performance since December. Nvidia shares closed at $118.58, representing the most significant drop since March 2020, during the onset of the Covid-19 pandemic. The plunge also resulted in Nvidia losing its title as the world’s most valuable publicly traded company, valued at $2.9 trillion, and falling to third place behind Apple and Microsoft.

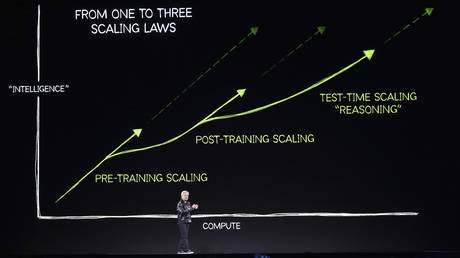

The downturn was ignited by DeepSeek's introduction of an open-source R1 model, which the company claims was trained in just two months and at a fraction of the cost incurred by US firms like OpenAI. This development has raised concerns about the sustainability of the high spending associated with AI, especially regarding Nvidia's dominance in the AI chip market.

Nvidia itself acknowledged DeepSeek's innovation as “an excellent AI advancement,” but asserted that it anticipates an increase in demand for its chips rather than a decline. “Inference requires significant numbers of Nvidia GPUs and high-performance networking,” a company spokesperson stated on Monday.

The selloff affected other tech and semiconductor companies beyond Nvidia. Broadcom's stock fell by 17%, erasing $200 billion in market value. Companies in the data center sector, which heavily rely on Nvidia's chips, including Oracle, Dell, and Super Micro Computer, also saw sharp declines of at least 8.7%.

Among the billionaires affected, Oracle’s chairman, Larry Ellison, experienced the most significant drop in net worth, losing $27.6 billion, according to Forbes. Nvidia CEO Jensen Huang's fortune fell by $21 billion, marking the second-largest personal loss.

The AI-driven stock surge over the past two years has made companies like Nvidia crucial to market optimism. Nvidia's shares surged 239% in 2023, spurred by demand from tech giants such as Alphabet, Meta, and Amazon.

This development comes at a time of rising tensions in the US-China AI competition. Despite US export restrictions on advanced chips, DeepSeek has managed to deliver competitive performance compared to OpenAI's o1, utilizing lower-spec GPUs.

US policymakers have started to pay attention to this competition. Venture capitalist David Sacks, who served as the White House's AI and crypto advisor under President Donald Trump, has called for a renewed emphasis on innovation to counter China's advancements.

“DeepSeek’s success shows that the AI race will be very competitive,” Sacks remarked on X, urging the US to remain vigilant. Another billionaire venture capitalist, Marc Andreessen, characterized DeepSeek's emergence as a “Sputnik moment” for American tech.

Thomas Evans for TROIB News

Find more stories on Business, Economy and Finance in TROIB business