Infographic: 50% of U.S. Households Own Merely 2.4% of the Nation's Wealth

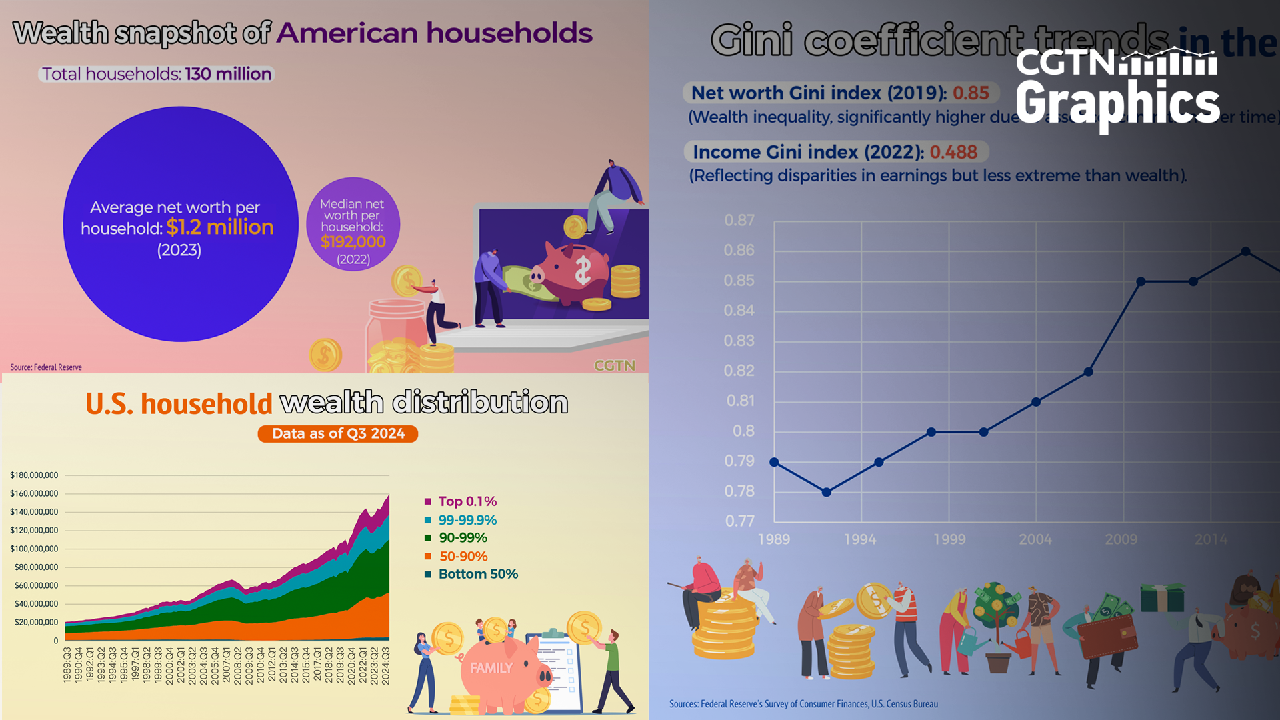

The Federal Reserve's Survey of Consumer Finances (SCF) revealed a Gini coefficient for net worth of around 0.85 in 2019, highlighting the ongoing issue of wealth inequality in the U.S. In contrast, the U.S. Census Bureau determined a Gini index for income inequality of 0.488 in 2022.

As of the end of 2023, American households reached a record net worth of $156.2 trillion. With around 130 million households in the U.S., this averages out to approximately $1.2 million per household. However, according to the Federal Reserve's 2022 analysis, the median net worth per household stands at $192,000, suggesting that half of U.S. households possess less than this amount.

Chinese netizens utilized this information and collaborated with the AI startup DeepSeek, which computed a Gini index of 0.823 for the U.S. The Gini index, which ranges from 0 to 1, indicates that a higher value—such as 0.8 for net worth—signifies significant wealth concentration among a small segment of households, illustrating the gap between the wealthiest individuals and the majority of the population.

Although this estimate may oversimplify the calculations of the Gini coefficient, which typically necessitates detailed distribution data—like wealth percentiles or household-level statistics—to accurately create a Lorenz curve, the data underscores the stark contrast between average and median net worth.

For context, the Federal Reserve's Survey of Consumer Finances reported a Gini coefficient of approximately 0.85 for net worth in 2019, highlighting persistent wealth inequality in the U.S. In contrast, the U.S. Census Bureau reported a Gini index for income inequality of 0.488 in 2022.

It’s noteworthy that the Gini index for wealth tends to be higher than for income due to the fact that wealth accumulates over time and is shaped by factors such as investments, inheritance, and other advantages that disproportionately favor top earners.

Moreover, data from the Federal Reserve for the third quarter of 2024 indicates that the bottom 50 percent of U.S. households collectively possess only 2.4 percent of the nation's wealth.

Alejandro Jose Martinez for TROIB News

Find more stories on Business, Economy and Finance in TROIB business