Graphics Show: China's Incremental Stimulus Helps Stabilize Economy

Graphics: China's gradual stimulus efforts are contributing to the stabilization of its economy.

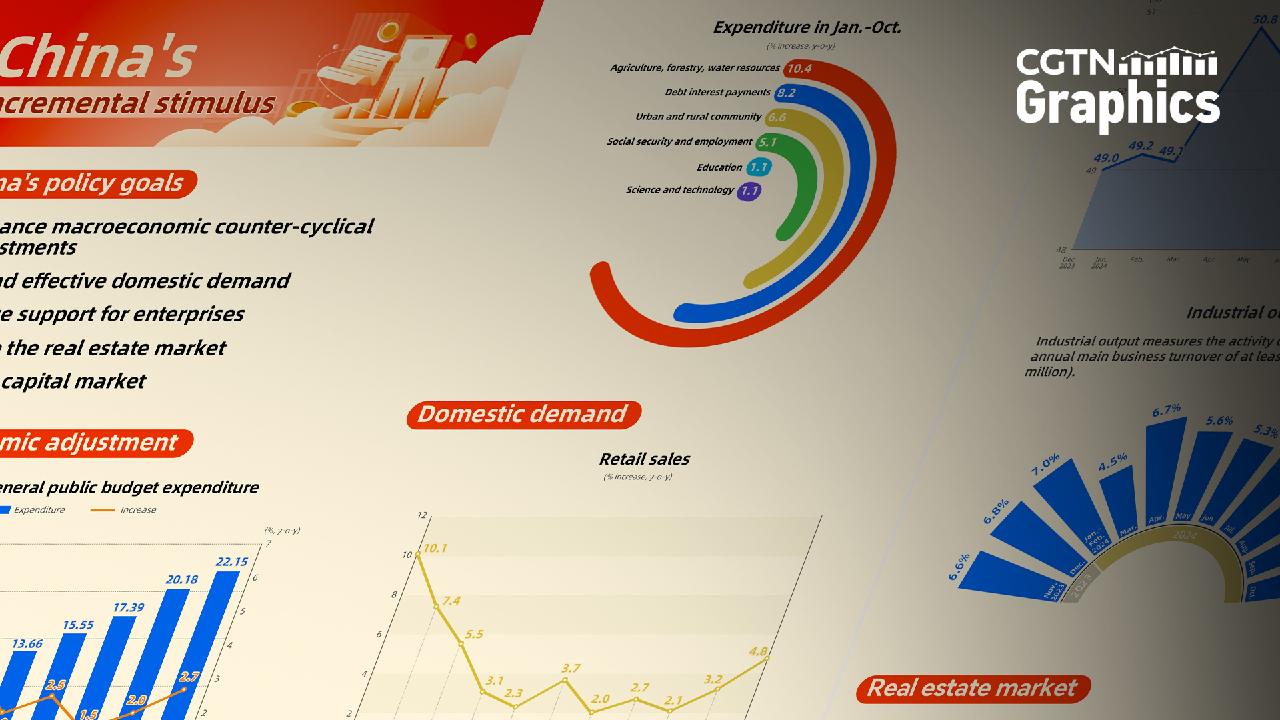

The latest round of stimulus measures emphasizes five primary areas: boosting macroeconomic counter-cyclical adjustments, enhancing effective domestic demand, providing greater support for enterprises, stabilizing the real estate sector, and invigorating the capital market.

**Macroeconomic Adjustment**

The country has adopted proactive fiscal strategies to bolster support for major strategic initiatives and improve the welfare of its citizens. This includes the issuance of 1 trillion yuan in super-long-term special government bonds and an increase of the local government special debt limit to 3.9 trillion yuan.

During the first ten months, the national general public budget expenditure reached 22.15 trillion yuan, a 2.7 percent rise compared to the previous year. Investment in crucial areas has grown, particularly in urban and rural communities, social security, employment, science and technology, and education.

**Domestic Demand**

Efforts to stimulate social investment and consumption have intensified to enhance domestic demand. Retail sales witnessed a resurgence starting in September, with new energy passenger vehicle sales soaring by 51 percent and sales of household appliances and audio-visual equipment rising by 20.5 percent, thanks to a new trade-in policy. In October, retail sales further increased by 4.8 percent, marking the highest rate of growth since February.

The growth of fixed-asset investment stabilized for the first time in September after several months of decline. Infrastructure investment growth jumped from 4.1 percent to 4.3 percent in October, indicating its first increase since March. Manufacturing investment, which had reached a low point in August, rebounded to 9.3 percent in October.

**Enterprise Activities**

The manufacturing Purchasing Managers' Index halted its decline in September, reversing a trend that had persisted since March. In October, it rose to 50.1 percent, crossing the 50-mark for the first time in six months, where a reading above 50 signifies economic expansion.

Industrial output, reflecting enterprise activity, saw its growth rate rebound in September following four months of declines.

**Real Estate Market**

In October, the second-hand home prices in first-tier cities registered positive month-on-month growth for the first time since September 2023. Notably, prices in Beijing, Shanghai, and Shenzhen increased by 1 percent, 0.2 percent, and 0.7 percent, respectively.

**Capital Market**

The capital market has also displayed a robust recovery trend. In October, the total turnover and volume of shares traded on the Shanghai and Shenzhen stock exchanges surged by approximately 1.5 times, representing the largest growth rate this year. Strong policy backing has elevated market sentiment significantly.

Debra A Smith contributed to this report for TROIB News

Find more stories on Business, Economy and Finance in TROIB business