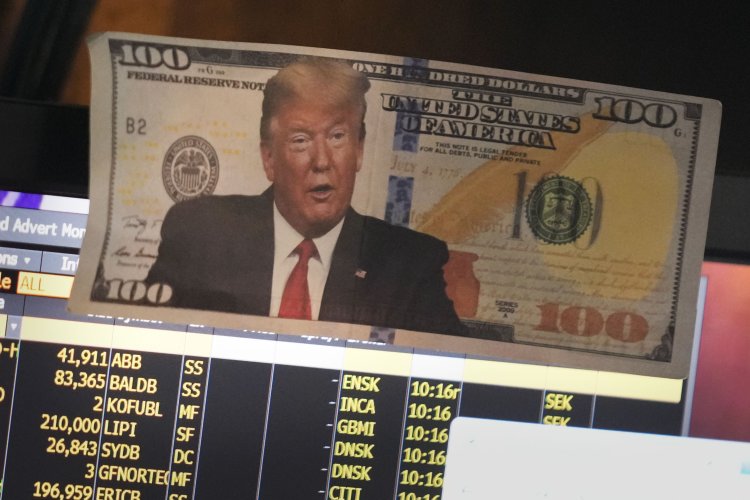

‘You’ll feel it’: The Impact of Trump’s Policies on the Dollar

Economists caution that any decline in the value of U.S. currency and debt securities has the potential to destabilize both Wall Street and personal financial situations.

The implications of this situation could be significant.

Dollars and U.S. debt securities serve as the lifeblood of global markets, and any decrease in their attractiveness could destabilize both Wall Street and individual financial situations, according to economists. Increased borrowing costs and higher import prices could result, leading to a decline in the value of investment assets that support retirement accounts. Additionally, the government’s capacity to maintain large deficits for programs like Medicare and defense could be adversely affected.

“Everything would be more expensive than you thought it would be. You’re not making as much as you thought, and the stock market isn’t getting the returns you expected,” posited Martha Gimbel, a former economist for the Biden administration and current head of the Budget Lab at Yale, a policy research center. "Things kind of become shittier."

This week, as Wall Street leaders and high-ranking Trump administration officials convene in Beverly Hills for the Milken Institute’s annual conference, the discussion will revolve around Trump’s handling of U.S. financial markets. Many of the president's initiatives, especially tax cuts and deregulation, are favored by industry leaders. However, his intense focus on tariffs has unsettled confidence in his ability to maintain the appeal of the dollar, Treasury securities, and other U.S. assets. Trump has indicated a preference for a weaker dollar while also vigorously defending its status as the world’s primary currency.

Since Trump's inauguration, the dollar's value against other currencies has diminished by approximately 9 percent. Demand for U.S. Treasuries, typically a safe haven for investors during turbulent times, declined after the president’s surprising “Liberation Day” tariff announcement.

It's important to note that it remains unlikely for any other currency to replace the dollar in the short term. The dollar still constitutes nearly 90 percent of all foreign exchange transactions, as reported by the Atlantic Council, and it holds a majority of foreign reserves. Nonetheless, Wall Street figures such as Citadel’s Ken Griffin, who will wrap up the Milken conference with a discussion, and JPMorgan Chase’s Jamie Dimon have cautioned that ongoing instability could undermine the U.S.'s global standing and its financial markets.

Trump has indicated that turmoil in the bond market impacted his decision to temporarily suspend the reciprocal tariffs placed on multiple trading partners. Following indications of a thaw in the trade conflict, the stock market has quickly rebounded. However, boosting the value of U.S. assets also makes imported goods less expensive, and Trump, along with his economic advisors, have suggested that they are prepared to endure short-term market pain if it ultimately strengthens domestic manufacturing and enhances U.S. exports.

Stephen Miran, who heads the White House Council of Economic Advisers, has pointed out that global demand for dollars places “undue burdens on our firms and workers, making their products and labor uncompetitive on the global stage,” characterizing the tariffs as a means to level the playing field. Treasury Secretary Scott Bessent has supported the administration's policies as a strategy to target nations that manipulate their currencies to secure trade surpluses.

“I’m very sympathetic to the case that it is an exorbitant burden rather than an exorbitant privilege,” remarked Oren Cass, founder of the right-leaning think tank American Compass and an ally of Vice President JD Vance and Secretary of State Marco Rubio. “It is certainly good for Wall Street and financial markets, but that has not proved to have a correlation with what is good for most American communities and typical American workers.”

“When I hear people say: ‘Well, we're seeing potential weakening of the dollar and we're worried that will reduce the dominance of American financial actors,’ I am not especially disappointed,” he added.

The term "exorbitant privilege," first introduced by former French finance minister Valéry Giscard d'Estaing in the 1960s, refers to the benefits the U.S. has gained through globalization. The world’s demand for dollars and U.S. debt securities has lowered government borrowing costs, enhanced the purchasing power of American consumers, and shielded the domestic economy from significant volatility in foreign currencies. While this has benefited the economy during prosperous times, it has proven particularly advantageous during challenging economic periods.

“The fact that the dollar has this special place in the global financial system gives us a lower interest rate on all U.S. borrowing than we would get otherwise,” noted Harvard University economist Ken Rogoff, who is set to release a book titled “Our Dollar, Your Problem” that discusses the dollar’s historical significance and uncertain future.

Consequently, the U.S. has been able to borrow more and at lower costs in response to crises, such as the 2008 financial collapse and the COVID-19 pandemic, which contributed to a faster economic recovery. If global demand for U.S. assets declines, it could complicate the government’s ability to finance stimulus efforts during economic downturns, potentially prolonging recovery times.

“If there's a recession — a monster recession, a crisis really — where the government wants to borrow massively? You'll feel it,” warned Rogoff.

However, Rogoff asserts that Trump’s policies have only intensified existing threats to the dollar.

Dollar dominance has rendered the global economy sensitive to the “whims of the U.S. president, whoever that is,” he stated. The combination of soaring peacetime deficits and foreign strategies to alleviate the effects of Western sanctions have already been encouraging international investors to diversify away from U.S. assets.

“The real problem is us,” Rogoff added. “The public is really not prepared to deal with having sustainable deficits — and that's one of the long-term weaknesses of the dollar.”

In a March 25 evaluation of the nation’s creditworthiness, Moody’s Ratings indicated that fiscal deficits and debt serviceability would likely worsen even if Trump’s policies result in a sustained period of above-average economic growth. This uncertain fiscal perspective — issued prior to “Liberation Day” — suggests that the U.S.’s borrowing capacity is becoming increasingly contingent on its “exceptional strengths” as the central hub for trade and finance, according to the ratings agency.

The potential risks posed by Trump’s agenda to these strengths — and the adverse effects that American citizens might encounter if tariffs remain in place — have led Wall Street leaders and economists to amplify their critiques in recent weeks.

While Trump’s policies and a weakened dollar might bolster domestic manufacturing, the benefits would likely be concentrated among a few, whereas costs would affect every consumer, explained Jason Furman, a former chief economic adviser to President Barack Obama and a Harvard professor.

The U.S. has some leeway to “screw up a decent amount” before the dollar's dominance is significantly undermined, Furman said. However, the recent turmoil has hastened the timeline for when such a shift might take place.

For the time being, “this feels to me more incrementally worse than it is like a regime change,” he added.

Navid Kalantari for TROIB News

Find more stories on Business, Economy and Finance in TROIB business