America’s allies are furious over trade rules. Democrats don’t care.

The Democratic lawmakers who created tax incentives for electric vehicles make no bones about their intention to benefit North American manufacturers and not their overseas competitors.

A congressional backroom deal to favor American factories is spiraling into a full-blown global trade conflict, with European and Asian allies furious at being cut out of lucrative U.S. tax credits for electric vehicles.

The European Union, South Korea and Japan are pressing President Joe Biden to weaken America-first manufacturing rules in his signature climate bill ahead of Jan. 1, when only electric vehicles assembled in North America will be eligible for rebates to consumers.

But despite Biden’s recent promises to address the situation, it’s not clear there’s much the administration can — or is willing — to do to prevent foreign-made cars from facing a big disadvantage in the American market. And congressional lawmakers, who could more easily change the law’s rules, are unrepentant.

“We did it to help the United States of America,” said Sen. Joe Manchin, who agreed to support Biden’s signature climate legislation in August after the inclusion of the domestic manufacturing incentives.

“It was all about the United States of America,” the West Virginia Democrat added.

The tensions over the provisions in the Inflation Reduction Act show how far Democrats are willing to go to ensure U.S. workers — and not those in China, or even allied nations — reap the benefits of green industries that will be huge drivers of the global economy for decades to come. The dispute is threatening to derail some of the United States’ strongest trading relationships at a time when the administration needs them to counter the economic toll of Russia’s war in Ukraine and China’s technological rise.

The compromise between Manchin and Senate Majority Leader Chuck Schumer was necessary to get the landmark Inflation Reduction Act to Biden’s desk. Manchin — a holdout for months of IRA talks among Democrats — made clear during bill negotiations he would only support the package if it included strict rules benefitting American-made electric vehicles and other clean energy technologies, like solar and batteries.

Under the law, Germany and South Korea will see exports of cars from their industrial heavyweights, Volkswagen and Hyundai, cut out of a $7,500 consumer tax credit that’s central to U.S. efforts to increase the production and sale of electric vehicles. Under the law, those advantages will now go only to vehicles built in North America with batteries and minerals sourced from the U.S. and select partners.

“The longer the IRA dispute lingers, the more the U.S. government will lose its credit among allies, making it more difficult to have them on board for the global common causes” like securing supply chains, a South Korean embassy official, who was not authorized to speak openly about the sensitive diplomatic issue, told POLITICO.

“I'd like to believe that it is a one-time incident rather than a turning point to deeper protectionism,” the official added. “But, unless redressed, it could cause the proliferation of harmful subsidies around the world.”

On the surface, Biden himself has been receptive to calls for cooperation from the allies.

During a visit last week from French President Emmanuel Macron, who has lambasted the law, Biden told reporters the two had discussed “practical steps to coordinate and align our approaches,” while Macron claimed the leaders had “agreed to resynchronize our approaches, our agendas in order to invest in critical emerging industries.”

"We're taking Europe's concerns very seriously, and you heard the big boss say that himself last week," U.S. Trade Representative Katherine Tai said Thursday.

But Democratic lawmakers and even Biden’s economic team freely acknowledge the law is supposed to benefit American workers ahead of their foreign counterparts.

“We make no apology for the fact that his economic strategy and the economic elements of these bills are designed to first and foremost build economic opportunity for communities across America,” said National Economic Council Director Brian Deese, calling Biden’s embrace of industrial subsidies in the IRA and CHIPS Act, which will bolster U.S. microchip manufacturing, “a marked departure from the economic philosophy that has governed for much of the last 40 years in this country.”

Ron Wyden, the Senate’s chief tax and trade lawmaker, also defended the law this week. “There is nothing — and we reviewed it very carefully — in trade law that says the United States of America can’t be taking steps to create good-paying jobs in America while it promotes [action on] climate change,” the Oregon Democrat said.

But foreign governments say their industries could become collateral damage. At a time when Europe faces sky-high energy prices and a war on its border, U.S. policies, they say, could siphon green investments out of the region and end up being counterproductive to the global goal of addressing climate change.

Over the past week, Macron and a confab of high-ranking U.S. and European officials elevated the new U.S. tax credits as a main point of contention. For weeks, Europeans have contended that the decision to favor car factories in the U.S. discriminated against European-made autos and disregarded their interest in accessing the U.S. market.

EU officials now say they are optimistic the two sides can reach a resolution, but they want a fix in place before the law takes effect on Jan. 1. And while the bloc hasn’t disclosed how it could escalate the issue further, leaders have already begun discussing the possibility of offering their own financial incentives.

“I think one war is enough," European Commission Executive Vice President Margrethe Vestager said this week, referring to Russia's invasion of Ukraine. "The second point I would make is that it's much faster to find a solution, than to deepen conflict. Conflict doesn't solve anything."

The European Union is not alone in its concern. South Korea and Japan have also been vocal, if less public, critics of the law’s tax credits. Both countries are key partners in the administration’s ongoing negotiations over a new economic framework in the Indo-Pacific that aims, in part, to secure critical supply chains separate from China for microchips, batteries and other important technologies.

Meanwhile, Canada and Mexico succeeded in lobbying last minute for eligibility under the tax credit to take into account the tightly integrated North American automotive supply chain.

Leading trade lawmakers and their staff insist that they did take trade considerations into account — and decided to give other nations a taste of their own medicine.

“Many countries, including our European partners, have long engaged in substantial investments in their domestic industries,” Rep. Dan Kildee (D-Mich.), a backer of the tax credits on the House Ways and Means Committee, said in response to allies’ criticisms of the law.

The actual terms of any resolution remain elusive and could involve stretching the interpretation of the law in ways that could open the government to lawsuits from unions or any other angry domestic industry. The Treasury Department is in charge of implementing the law at the start of 2023, and Biden said it could be done in a flexible manner. Hill staffers and former administration officials warn that a loose interpretation poses risks, because the law’s language is quite explicit about favoring U.S. producers.

“They will get sued and lose,” if they try to significantly change the law, said a staffer for a Ways and Means member.

Republicans broadly opposed Biden’s climate legislation, and for some lawmakers, the tax credits were among the reasons. There are free traders, for instance, who argue the subsidies were poorly vetted and, as a result, threaten to undermine global trade relationships.

“How can we hold other countries to account for their trade commitments if we don’t fulfill our own?” said Rep. Adrian Smith (R-Neb.), the top Republican on the Ways and Means Trade Subcommittee. “We must promote domestic manufacturing and strengthen supply chains without compromising relations with our trading partners.”

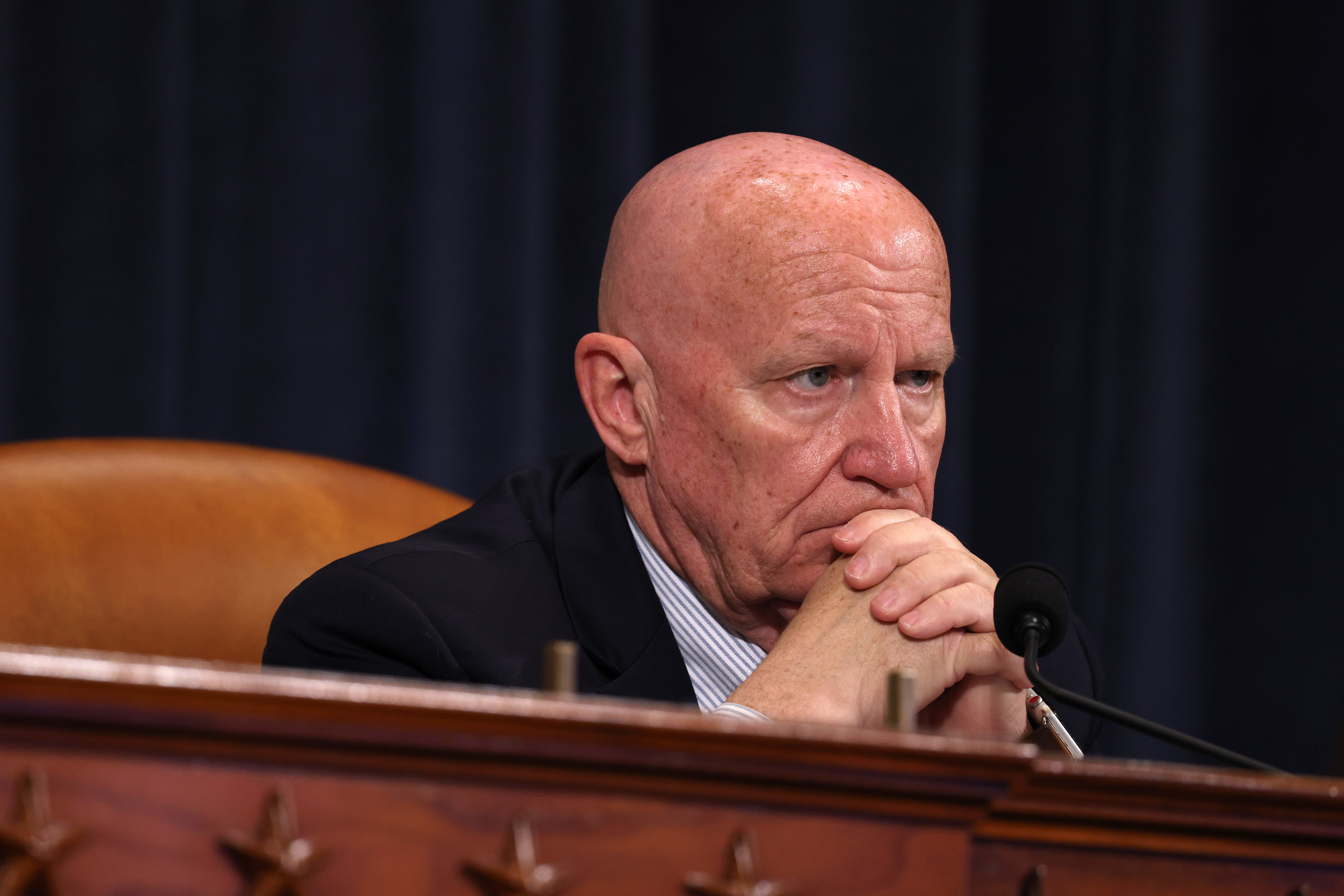

Rep. Kevin Brady (R-Texas), the top Republican on the Ways and Means Committee, said he needed to “fact check” Biden on his statement that he never intended the law’s tax provisions to come at the expense of allies.

“The fact of the matter is they knew, absolutely knew, because of trade missions from [Canadian] Prime Minister Trudeau, discussions we had with the EU, Korea and others that they were risking a trade war and retaliation against American products and services if they went forward. And they went forward as it is,” said Brady, who is retiring at the end of this Congress.

“They broke it; they need to fix it,” he said of Democrats’ need to mend trade relationships.

Doug Palmer contributed to this report.

Find more stories on the environment and climate change on TROIB/Planet Health