Trump Claims He Has the Power to Remove Independent Fed Chair Powell

U.S. President Donald Trump reiterated on Thursday that he could potentially force out Jerome Powell, the head of the independent Federal Reserve, after Powell expressed concerns about inflation driven by tariffs. While addressing reporters...

While addressing reporters at the White House, Trump asserted that Powell would "leave if I ask him to." He added, "I'm not happy with him. I let him know it and if I want him out, he'll be out of there real fast, believe me."

In a critical post on Truth Social, Trump also called on Powell to lower interest rates, emphasizing that his "termination... cannot come fast enough."

According to sources cited by the Wall Street Journal, Trump has been privately contemplating the dismissal of Powell for several months but has yet to reach a final decision. The topic has reportedly come up during private meetings at Mar-a-Lago with former Fed Governor Kevin Warsh.

Although the U.S. president lacks the direct authority to fire Federal Reserve governors, Trump could initiate a complicated process to attempt to remove Powell if he can establish "cause."

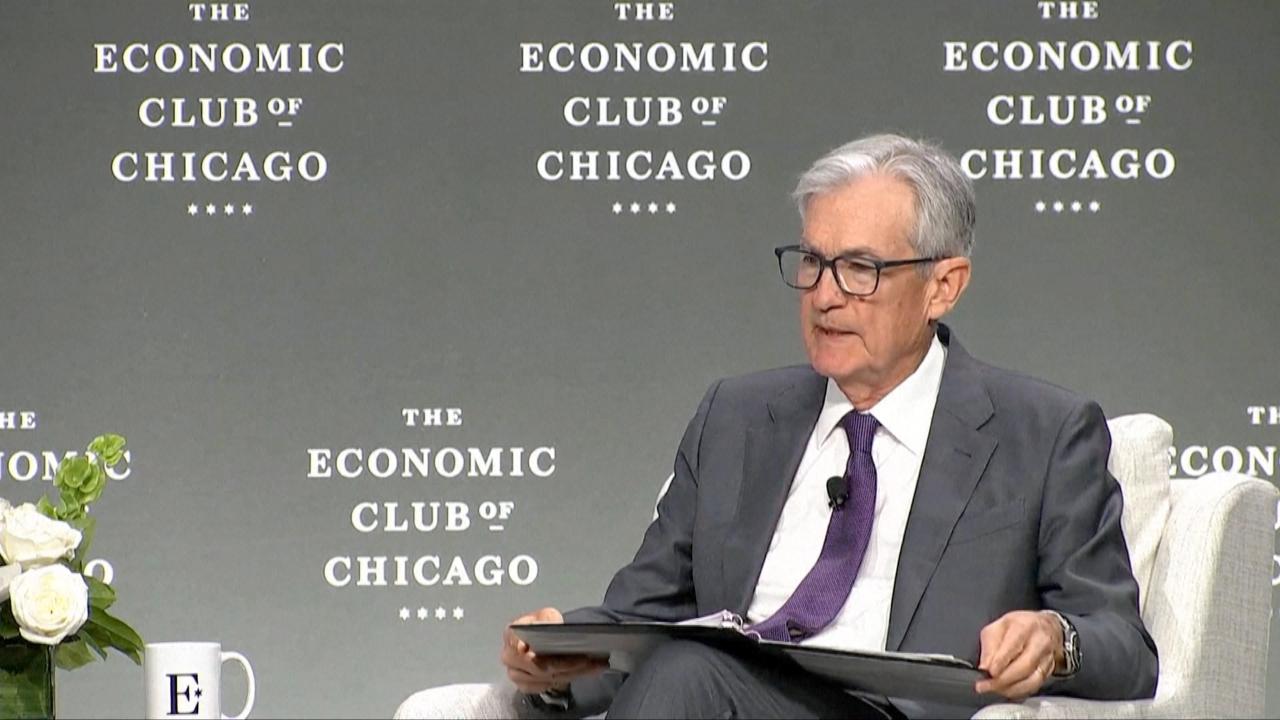

Powell warned on Wednesday that Trump's broad tariffs on nearly every trade partner could force the Fed into a difficult position of choosing between controlling inflation and managing unemployment.

Trump's inconsistent tariff strategy has created uncertainty among investors and governments worldwide regarding his long-term intentions and implications for international trade.

Currently, the U.S. central bank has maintained a cautious approach to reducing rates, keeping them steady at 4.25 to 4.5 percent since the beginning of the year.

Trump has often criticized Powell, whom he initially nominated during his first term, claiming Powell is engaging in political decision-making. His previous posts have indicated dissatisfaction with Powell’s timing, with Trump suggesting Powell's actions were "Too Late" and advocating for alignment with the European Central Bank’s recent decision to lower its benchmark deposit rate by a quarter point.

During his campaign in August, Trump proposed that the White House should play a role in shaping monetary policy.

Despite the tensions, Powell made it clear on April 4 that he has no intentions of resigning before his term expires next year, stating, "I fully intend to serve all of my term." At that event in Virginia, he also noted that the Fed was not in a hurry to reduce its benchmark lending rate from its current elevated levels.

Financial markets are predicting a roughly two-thirds likelihood that Fed policymakers will vote to keep rates unchanged in their upcoming meeting in May, as reported by CME Group data.

Setting key interest rates is a primary tool the Fed uses to fulfill its dual mandate of managing inflation and unemployment. Lowering interest rates typically makes borrowing cheaper, stimulating economic growth by encouraging investment, while raising or maintaining higher rates helps to control inflation.

As of March, U.S. year-on-year consumer inflation has slowed to 2.4 percent, nearing the Fed's long-term target of two percent, partly due to a significant 6.3 percent drop in gasoline prices, according to official statistics.

Sophie Wagner contributed to this article for TROIB News

Find more stories on Business, Economy and Finance in TROIB business